Request a free sample

Can this Wall Street roller coaster stay on track?

Despite renewed technical strength in the market and a slight decrease in inflation, the battle between the bulls and bears is getting even hotter. Several crucial indicators remain in the danger zone. Many macroeconomic indicators that saw improvement earlier this year have since reversed course… These reversals span the economy and have us wondering if things may not be as strong as the market believes. In this issue of InvesTech, we delve into these concerns and many important technical measures while the battle between the bulls and bears rages on…

A subscription to InvesTech is more than an investment newsletter…

The following subscriber resources are included with a subscription to InvesTech Research. This arsenal of tools will keep you up-to-date with our market outlook, monitor our indicators in real-time, follow news & data releases, and keep tabs on our portfolio recommendations.

InvesTech Issues

The monthly InvesTech Research newsletter contains both monetary and technical analysis and unique research.

Market Insights & Economic Trends

Keep up with timely economic news and data releases and how these may affect your investing.

Weekly Hotline

Updated each Friday to provide a summary of the week’s important data releases, technical updates, and any changes to the Model Fund Portfolio.

Model Fund Portfolio

View the current investment allocation in our Model Fund Portfolio and access the latest trades as they happen.

InvesTech Indicators

Follow InvesTech’s proprietary technical indicators daily to watch for important breakouts or warning flags.

Subscriber Library

Read some of our favorite Special Reports from over the decades, and continue to gain a more in-depth understanding of the market as we post new content!

InvesTech Research: A Proven Track Record for Over 40 Years

InvesTech Research offers a unique “safety-first” investing strategy to our readers located throughout the United States and 43 countries around the world. We use proven proprietary models and objective analysis to provide clear, researched market analysis you can rely on.

InvesTech Research is Frequently Quoted in the Following:

Ignore Below – Old blocks in case we want to bring them back

A subscription to InvesTech is more than an investment newsletter…

The following subscriber resources are included with a subscription to InvesTech Research. This arsenal of tools will keep you up-to-date with our market outlook, monitor our indicators in real-time, follow news & data releases, and keep tabs on our portfolio recommendations.

InvesTech Issues

The monthly InvesTech Research newsletter contains both monetary and technical analysis and unique research.

Market Insights &

Economic Trends

Keep up with timely economic news and data releases and how these may affect your investing.

Weekly Hotline

Updated each Friday to provide a summary of the week’s important data releases, technical updates, and any changes to the Model Fund Portfolio.

Model Fund Portfolio

View the current investment allocation in our Model Fund Portfolio and access the latest trades as they happen.

InvesTech Indicators

Follow InvesTech’s proprietary technical indicators daily to watch for important breakouts or warning flags.

Daily Data

Daily access to a wide range of stock market metrics, including market indexes, breadth/volume data, and short-term indicators.

Presentation Videos

The InvesTech Research Analytical Team had the pleasure of speaking at the 2024 Glacier Summit Wealth Conference hosted by Stack Financial Management in June. Several recorded presentations from the conference will be made available right here on the InvesTech website over the coming weeks.

A recording of the InvesTech presentation: Time-Tested Indicators for Safety-First Investing is now available to watch, right here on the InvesTech website!

Kiplinger

Rated Best Source of Investment Advice by Kiplinger Personal Finance Magazine.

Best Stock Market Letter

InvesTech Research, which promises ‘safety-first profits,’ has bested the overall stock market over the long haul with less risk. Publisher James Stack analyzes economic, monetary and market data (some going back more than 100 years) to make market calls and recommend allocations. – Kiplinger Personal Finance

InvesTech Research is Frequently Quoted in the Following:

Visit our In The News to read more.

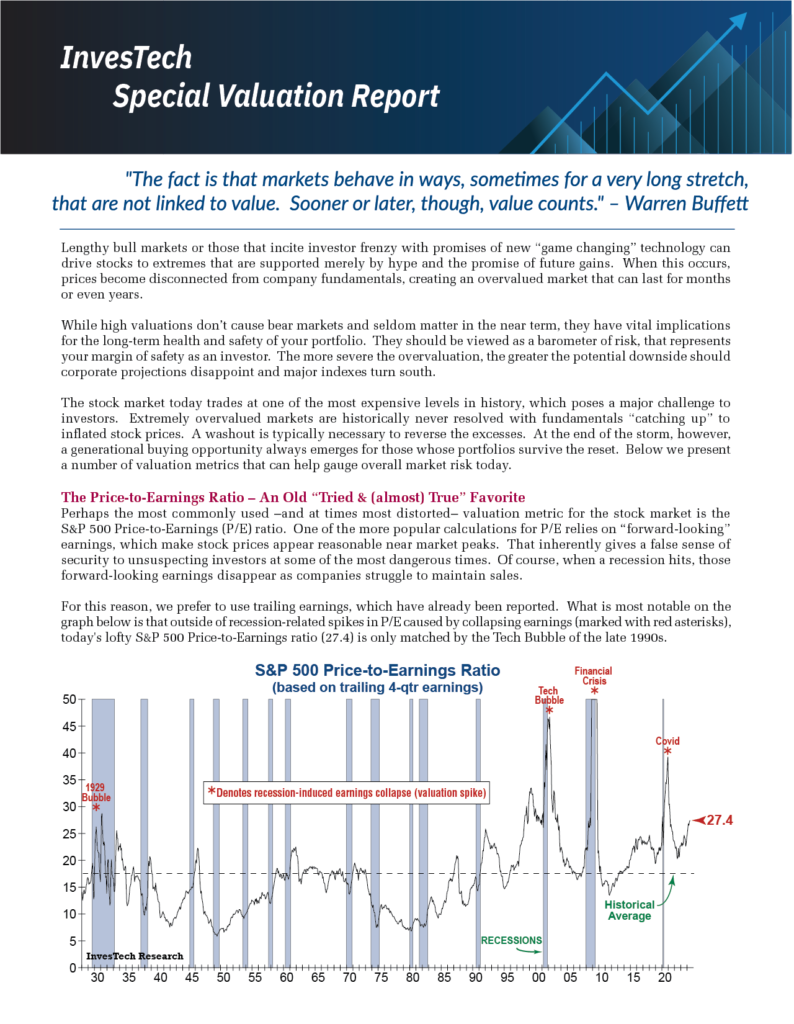

InvesTech Special Valuation Report

With outlandish valuations hanging over this market like a storm cloud, we’ve released a new special report. It breaks down the most well-known valuation measures and what they are telling us today. Past periods of lofty valuation have provided crucial lessons which we detail in this report.