testing

BioMarket Insights

Market Insights & Economic Trends

Keep up with InvesTech’s review of economic news and data releases and how these may affect your investing. Visit regularly for new Market Insights & Economic Trends.

You must be logged in to view all of the following articles.

If you are a subscriber and some of the following articles are not available for you to read, please ensure you are logged into your online account. If you are not a subscriber and are interested in reading more, visit our Subscription Offers to sign up!

One More Time

MI & ET Testing 1-10-2024

Market Insight – Testing

excerpt text here for public

BioLeading economic indicators rise, but at a much slower pace…

The Conference Board’s Leading Economic Index (LEI) increased to another record high in September, yet last month’s growth of 0.2% missed economists’ expectations and was the second slowest reading since last year’s COVID-induced recession.

BioProducers feel the pinch

The Producer Price Index (PPI) for Finished Goods climbed from 10.2% to 11.7% in September, the highest reading since November of 1980.

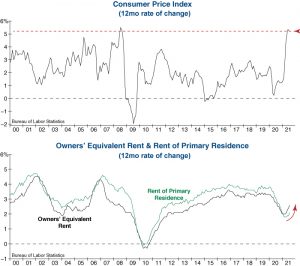

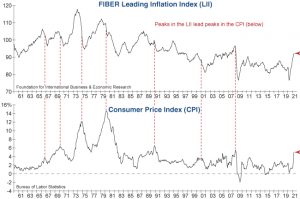

BioInflation just won’t quit

The Core Consumer Price Index (CPI), which excludes food and energy prices, moved slightly higher to 4.0% on an annual basis in September to remain near a 30-year high.

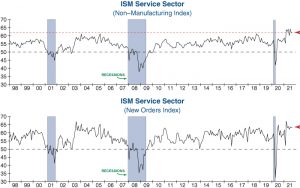

BioThe service sector remains robust

The ISM Services Index exceeded economists’ expectations by ticking higher to a reading of 61.9 in September.

BioThe Fed has an inflation conundrum

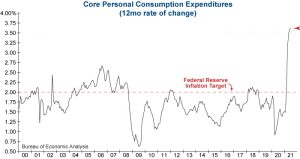

Core Personal Consumption Expenditures (PCE) –the Federal Reserve’s preferred inflation measure– edged up slightly to 3.62% from 3.60% for the month prior.

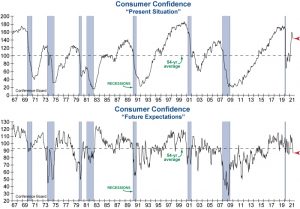

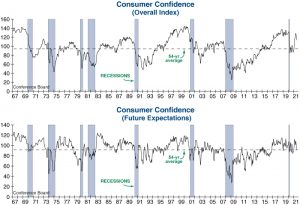

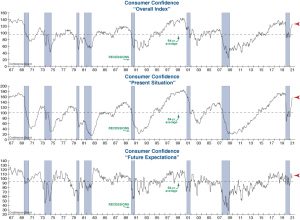

BioConfidence continues to tumble in September

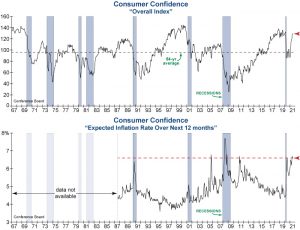

Consumer Confidence from the Conference Board continued to worsen in September as fears over inflation and the COVID-19 Delta variant persist.

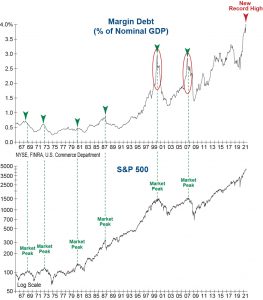

BioSpeculative Borrowing Re-engages

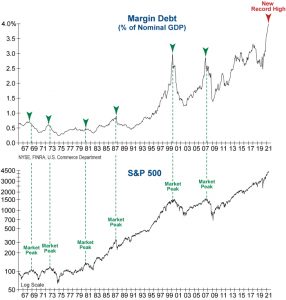

The latest margin debt reading showed that speculation regained momentum last month as it surged to yet another record high.

BioThe Leading Economic Index continues to advance

The Conference Board’s Leading Economic Index (LEI) exceeded economists’ expectations by jumping +0.9% in August.

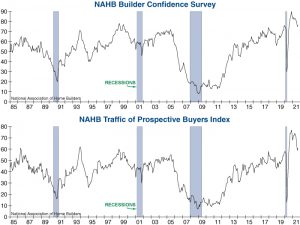

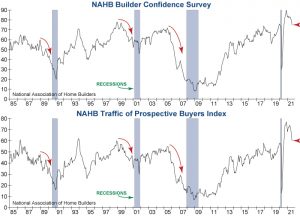

BioHomebuilder confidence stabilizes… for now

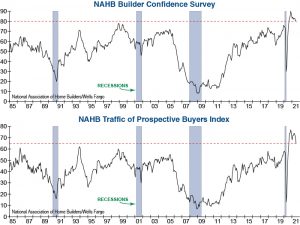

NAHB Builder Confidence registered a warning flag last month after it fell sharply to a 13-month low, yet it managed to rebound by one point in September.

BioInflation stays high as sticky prices are poised to pick up the slack

The Consumer Price Index ticked down to 5.3% from 5.4% last month and remained at one of the highest readings of the past twenty years.

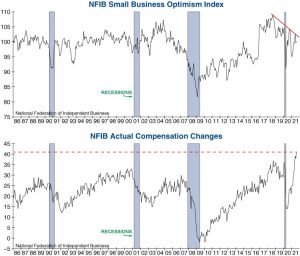

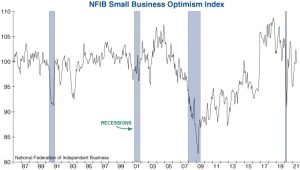

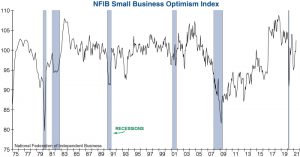

BioInflation continues to weigh on small business optimism

The NFIB Small Business Optimism Index increased by a meager 0.4 points in August (top graph) as small business owners continue to contend with both rising input costs and labor challenges.

BioIs speculation starting to fade?

The speculative frenzy that was ignited by the trillions of dollars in monetary and fiscal stimulus since the pandemic began may be starting to dissipate, according to our InvesTech Investor Psychology Barometer (IIPB).

BioProducer prices surge to record levels

The Producer Price Index (PPI) surged to an all-time high of 8.3% in its most recent reading, showing that supply/demand imbalances are persisting.

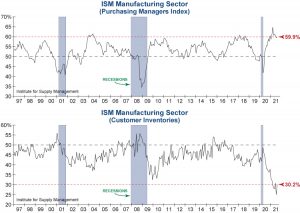

BioManufacturing remains strong, but challenges remain…

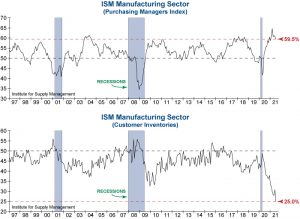

The ISM Manufacturing Index moved higher to a reading of 59.9% in August to remain near one of the highest levels of the past two decades.

BioConsumer confidence craters in August

Consumers became significantly more pessimistic in August due to a combination of persistent inflation pressures and fears over the Delta variant.

BioThe Fed’s preferred inflation measure still running hot

Core Personal Consumption Expenditures (PCE), which excludes volatile food and energy prices, rose for the fifth straight month to 3.62% versus the prior month’s unrevised reading of 3.5%.

BioLeading economic indicators show strength

The Leading Economic Index (LEI) from the Conference Board improved once again in July, taking the Index to another record high.

BioLeading housing indicator raises a warning flag

NAHB Builder Confidence (top graph below) sank to a 13-month low in August after suffering its fourth largest drop of the past decade.

BioSmall businesses voice concern about the future

NFIB Small Business Optimism Index unexpectedly declined by -2.8 points to a reading of 99.7 as economic expectations retreated in July.

BioManufacturing remains strong but moderates

The ISM Manufacturing Index declined by -1.1% to 59.5% in July, yet it remains at one of the highest levels of the past 30 years.

BioThe Fed’s preferred inflation measure continues to rise

Core Personal Consumption Expenditures (PCE) –the preferred inflation measure of the Federal Reserve– climbed further beyond the central bank’s 2% inflation target to 3.5% last month.

BioConsumer Confidence Steady Despite Inflation Concerns

Consumer attitudes were virtually unchanged in July...

BioLEI continues to climb

The Leading Economic Index (LEI) from the Conference Board gained 0.7% last month on positive contributions from eight of its ten leading components.

BioMargin debt stays the course

Margin debt climbed in June for the eighth straight month as investors continue to borrow on margin to buy stocks.

BioHomebuilders remain optimistic

Homebuilders became slightly less optimistic this month according to the National Association of Home Builders, yet their confidence remains higher than at any point prior to the COVID-19 pandemic.

BioCOVID-19 recession declared shortest on record

The National Bureau of Economic Research (NBER) has officially announced that the pandemic-induced recession has ended.

BioSmall business optimism improves

Small businesses became more optimistic last month as the economic recovery continued to gain momentum.

BioInflation surges in June

The core Consumer Price Index (CPI), which excludes volatile food and energy prices, continued to surge in June.

BioServices remains on solid ground

The ISM Services Index fell to a reading of 60.1% in June, still firmly in expansion territory and just 3.9% below its record high from the month before.

BioManufacturing remains red hot

The manufacturing sector stayed soundly in expansion territory in June, as the ISM Manufacturing Index registered a strong reading of 60.6.

BioConsumer confidence rebounds, but…

Consumer Confidence from the Conference Board increased for the fifth consecutive month as pandemic woes continued to fade.

BioLeading inflation indicator points higher

Inflation has emerged with a vengeance in recent months, and the FIBER Leading Inflation Index (LII) suggests that that pricing pressures are continuing to mount.

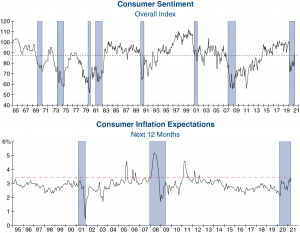

BioConsumer optimism emerges, yet inflation lurks

Consumer optimism has been held down by the pandemic over the past year, but attitudes have started to improve as COVID-19 disruptions begin to fade.

Bio