1987 Crash > Bull Market of the 1990s > 2000 Tech Bubble > 2007-09 Financial Crisis > InvesTech Recent Performance

InvesTech Research has spent decades analyzing the markets and protecting subscribers from the brunt of bear markets while identifying safer profit opportunities.

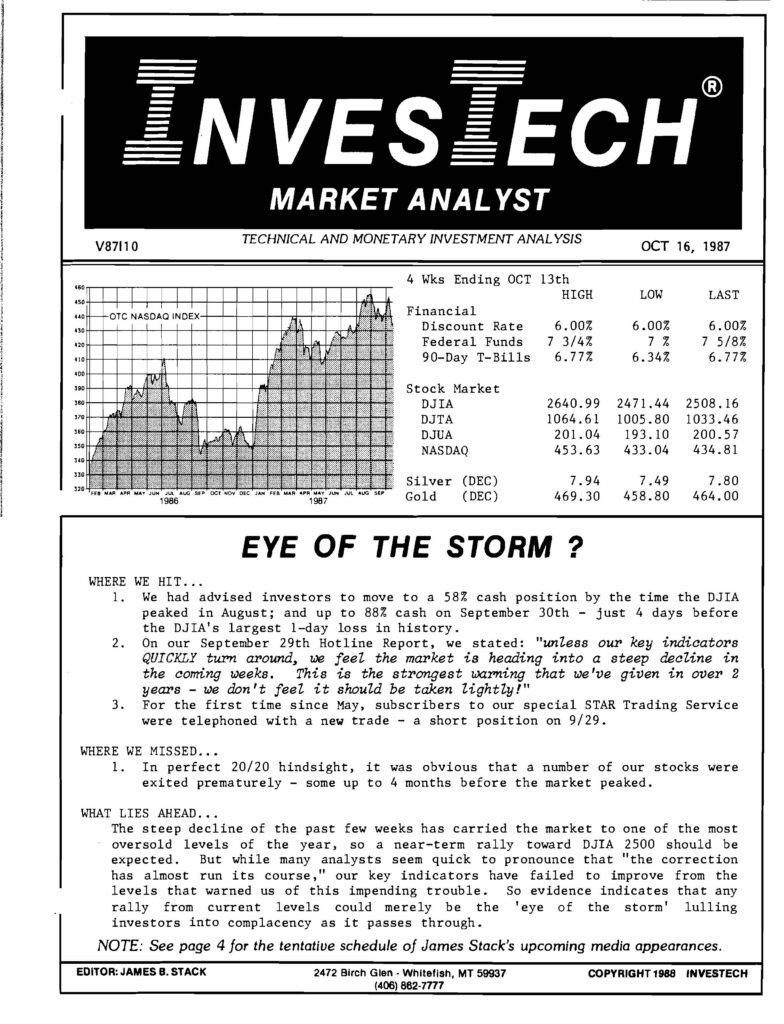

1987 Crash – Black Monday

Published the week before “Black Monday,” as Wall Street pundits insisted that the market’s recent 200-point drop was nothing more than a “correction.” InvesTech moved investors to 100% cash just before the 1987 Crash, when stocks lost 25% of their value in a single day.

Jan. 4, 1988 – From his office overlooking Whitefish Lake in the Rocky Mountains of Montana, Jim Stack foresaw the stock market crash of Oct. 19. On Sept. 30, his InvesTech newsletters told stock investors to move to 94% cash.

USA Today

“…while many analysts seem quick to pronounce that “the correction has almost run its course,” our key indicators have failed to improve from the levels that warned us of this impending trouble. So evidence indicates that any rally from current levels could merely be the ‘eye of the storm’ lulling investors into complacency as it passes through.”

InvesTech Research – October 16, 1987

“I’ve been a subscriber since 1986. Mr. Stack has done a very good job of investing during ‘safe’ times and preserving capital when risk is high.”

E.T.W., Glendale, AZ

Only five newsletters predicted plunge

Oct. 22, 1987 – Hulbert Financial Digest is also bullish on InvesTech Market Analyst. The last stock in [InvesTech’s] model fund portfolio was sold October 16, three days before the crash. InvesTech said monetary conditions and technical factors pushed them towards caution.

Expert Advice on Investing

Jan. 4, 1988 – From his office overlooking Whitefish Lake in the Rocky Mountains of Montana, Jim Stack foresaw the stock market crash of Oct. 19. On Sept. 30, his InvesTech newsletters told stock investors to move to 94% cash.

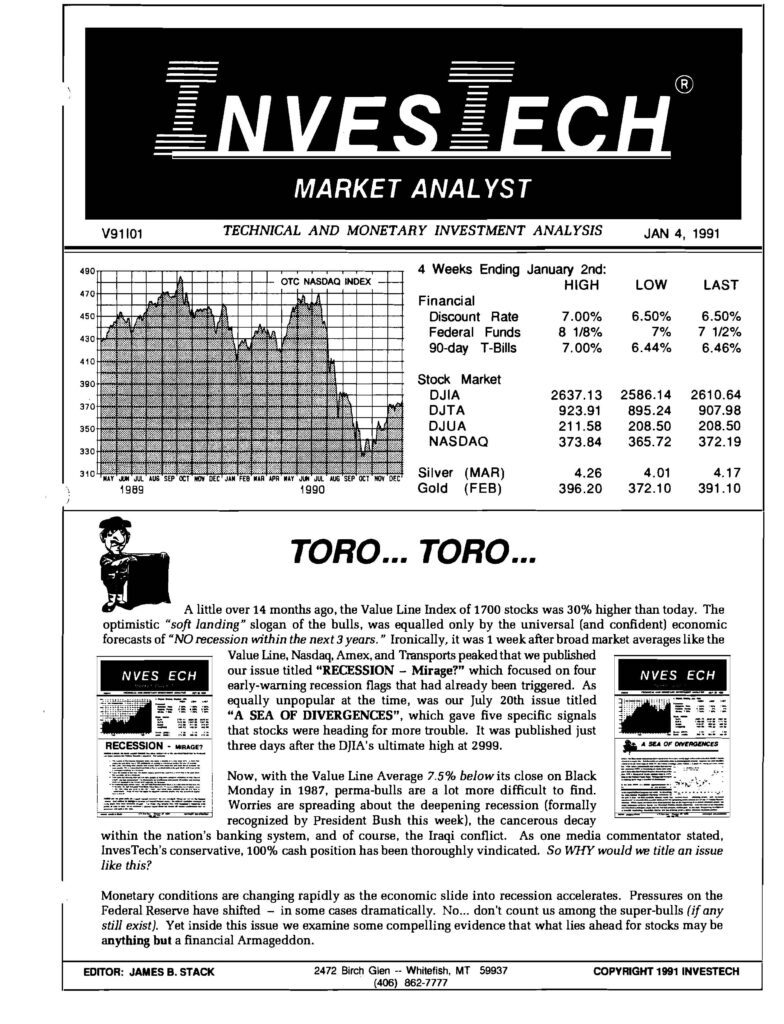

Decade-long bull market of the 1990s

Just 13 days after this issue was mailed on January 4, 1991, the stock market blasted off on an advance that would take it up more than 1000 DJIA points. While most economists and analysts were still forecasting another 12 months of recession ahead, InvesTech subscribers were able to get in at the beginning of the 1991 bull market.

“Monetary conditions are changing rapidly as the economic slide into recession accelerates. Pressures on the Federal Reserve have shifted – in some cases dramatically… inside this issue we examine some compelling evidence that what lies ahead for stocks may be anything but a financial Armageddon.”

InvesTech Research – January 4, 1991

“I’d like to offer a special word of praise for all the work the entire InvesTech staff of professionals does to help bring meaningful technical and fundamental insights to the attention of your subscribers. There is no one who can compare with what you do or the way in which you do it.”

P.E.P., Ph.D., Okemos, MI

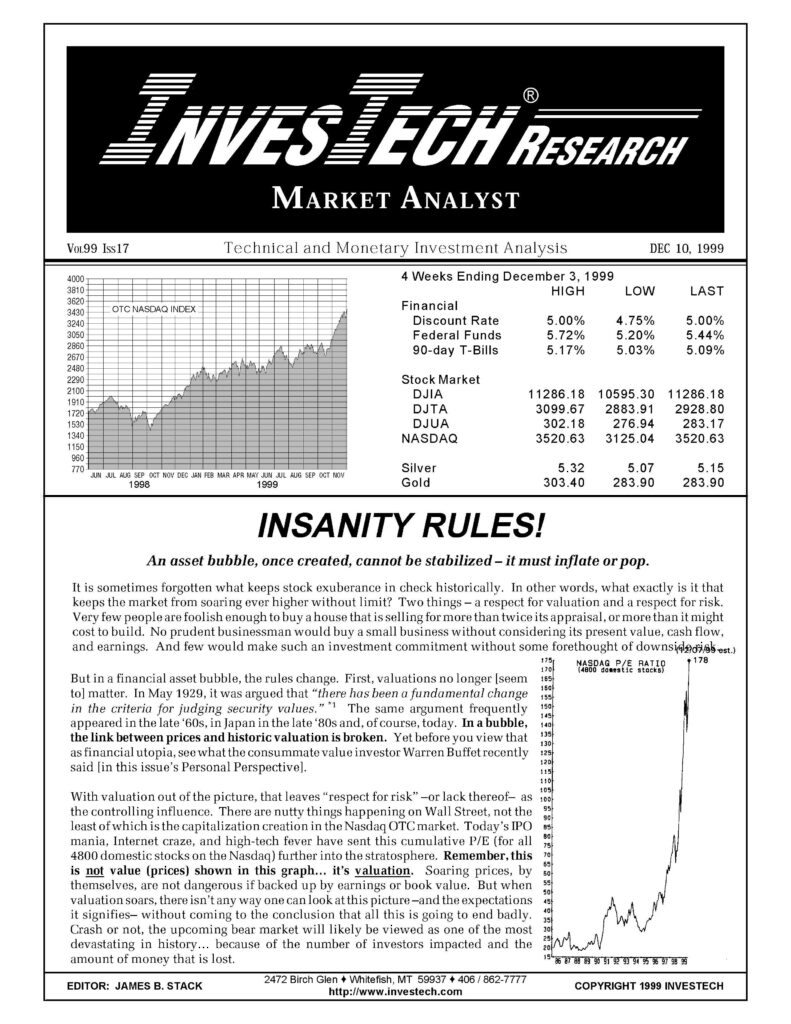

2000 Tech Bubble

InvesTech made headlines when it defied Wall Street, and warned of one of the most important tops in history. Subscribers survived the 2000-02 Tech Bubble collapse with their portfolios almost entirely intact.

Crash or not, the upcoming bear market will likely be viewed as one of the most devastating in history… because of the number of investors impacted and the amount of money that is lost.

InvesTech Research – December 10, 1999

“Please convey my gratitude to Jim and everyone there for keeping me out of the devastation of the 2000-2001 market. I felt lucky to have dodged a massive destruction of my portfolio.”

T.K., Los Altos, CA

From Afar, an Analyst Gets It Right

Aug. 19, 2001 – Just over a year ago, James Stack stood before 5,000 people at an investment trade show in Las Vegas and warned of the coming stock market collapse.

“Many investors have taken leave of their senses,” he told the attendees at the May 16, 2000 conference, and “the losses will change their lives.” The prediction, which proved accurate, was all the more remarkable because none of the 160 other market experts who spoke at the show agreed with Mr. Stack’s bearish sentiment. Mr. Stack has often been the lonely voice. More significantly, he’s often been right.

High-Tech Stocks Are Low On Newsletter Editor’s List

Dec. 9, 2001 – “Jim Stack was a bear on the stock market—an angry, snarling bear…Today, he is rightly considered a hero for warning subscribers of his InvesTech market newsletter, and anyone else who would listen, away from stocks as they climbed toward their peaks and then careened into the worst decline in a generation.”

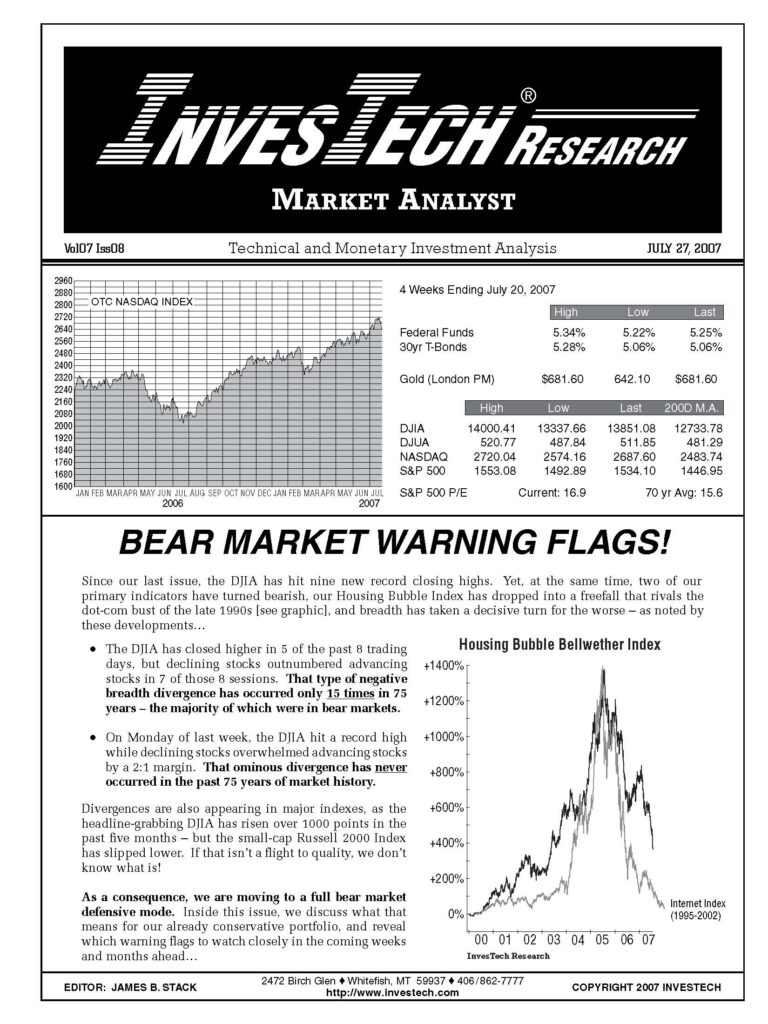

2007-09 Financial Crisis

InvesTech warned in July of 2007 that Bear Market Warning Flags were piling up…. and proceeded to safely lead subscribers through the Great Recession, limiting losses to less than half of the market’s 57% decline.

Since our last issue, the DJIA has hit nine new record closing highs. Yet, at the same time, two of our primary indicators have turned bearish, our Housing Bubble Index has dropped into a freefall that rivals the dot-com bust of the late 1990s, and breadth has taken a decisive turn for the worse…

InvesTech Research – July 27, 2007

“You guys add sanity to more than counterbalance what you see and hear in the so-called ‘business news.’ Thank you for helping me keep my family’s financial plan on course.”

B.P., San Juan Capistrano, CA

Newsletter editor gets defensive

Sept. 6, 2007 – “InvesTech says that “Bull markets don’t die of old age, they die from deterioration and economic imbalances, and we are seeing economic imbalances now.”

Surviving in a Hostile Market

Nov. 6, 2007 – “The wild card today, according to Stack, is the bursting of the housing bubble, which developed more as a result of leveraged mortgage products than from overpriced houses. It’s only a matter of time, he says, until the housing debacle and credit crisis adversely impact the overall economy, increasing the likelihood of a recession.

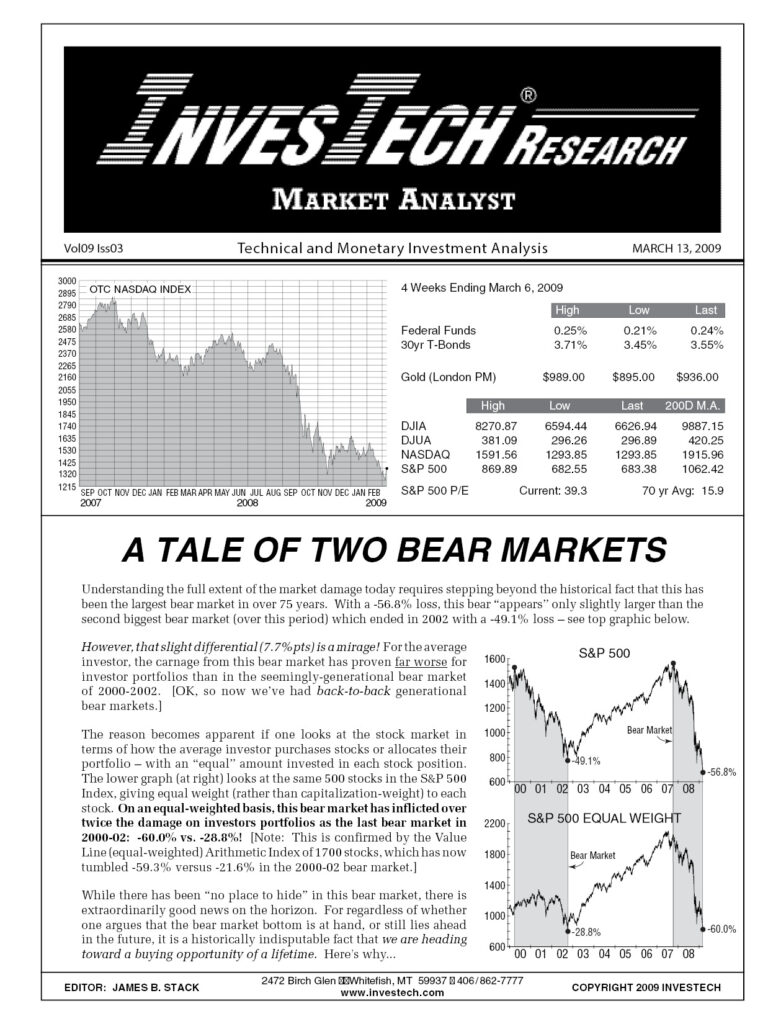

Then in March 2009 –just 4 days after the bear market bottom– InvesTech boldly advised subscribers that we were “heading toward a buying opportunity of a lifetime!”

Inside this issue, we present convincing evidence that Wall Street is heading toward one of the best buying opportunities in decades. It might be a buying opportunity at prices that we won’t see again in our lifetime. And, in fact, it might already be here.

InvesTech Research – March 13, 2009

“I just want to tell you how much I appreciate your “safety-first” approach over the years… I have made and saved a boatload of money. I was able to sidestep the 2000 market drop as well as the 2009 drop, and then Jim gave me the courage to get back into the market when that seemed like folly. Thank you.”

C.M., Hutchinson, MN

Excerpt – InvesTech Research, March 13, 2009

A Buying Opportunity of a Lifetime?

We don’t need to tell you what’s wrong with this economy, or stock market. It’s plastered in big, BOLD HEADLINES across the Internet and newspapers every morning…

“Unemployment is soaring!”

Of course it is – but no faster or higher than in the other 2 recessions of the past 70 years that lasted this long.

“This could be the longest recession since the Great Depression!”

Another no-brainer – as we only have two months to go before surpassing the recessions of 1981-82 and 1973-74.

“Corporate profits are falling, with no end in sight!”

Happens in every recession – and earnings always bottom long after the bear market bottoms out.

All of this bad news, of course, is why the bear market has lost well over 50% in virtually all major indexes. Yet, although our model portfolio was not immune, we have limited our losses to barely half that of the S&P 500 Index. If ranked among the 2400 growth and value mutual funds monitored by Morningstar and available on FastTrack, our model portfolio would be ranked #11.

We’ll leave the controversial question of whether this bear market is at, or near, a bottom until later in this issue. First, we want to focus on a far more important topic from a longer-term viewpoint: Why we believe the stock market is approaching a buying opportunity of a lifetime.

Time to Say Goodbye to the Bear?

Mar. 10, 2009 – “A savvy market watcher, who has been correctly bearish on stocks, [Jim Stack] says the next bull market will likely start soon – and it should be a big one.”

InvesTech’s Model Fund Portfolio Recent Performance

As an investor in today’s volatile markets, you naturally have questions about our strategy and the performance of our Model Portfolio. Over the past 40+ years, InvesTech has earned a widely respected reputation for our objective analysis and safety-first investment philosophy. While profits are important, we know that is only half the picture. Preserving one’s portfolio through a severe bear market can make the difference between a comfortable retirement and financial disaster.

Click here for more information and to view the performance of the InvesTech Research Model Fund Portfolio over the past 25 years.