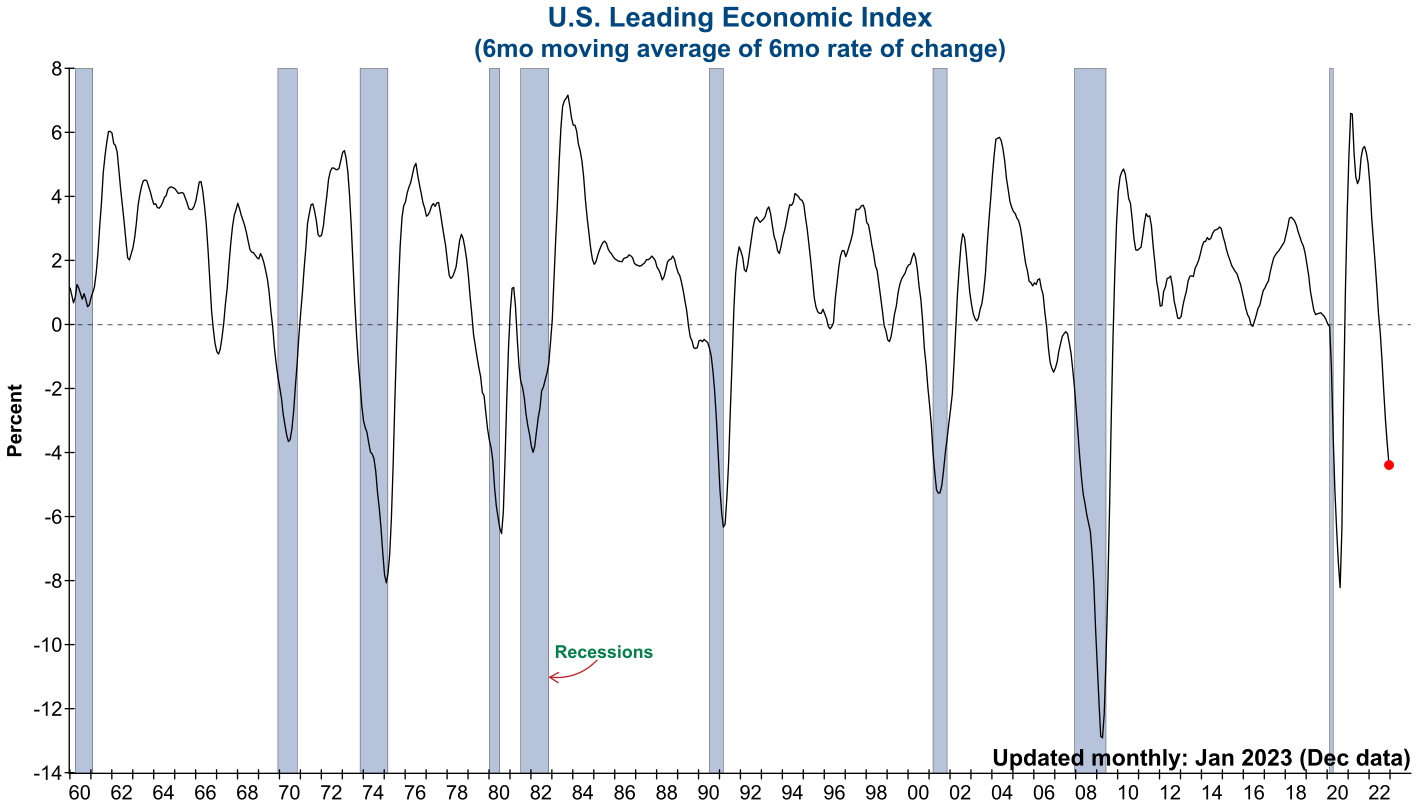

The Conference Board’s LEI is a monthly index based on 10 components, both financial and non-financial, that anticipates turning points in the business cycle. The latest data for December came in at 110.5, a decrease of 1%. This represents its 10th consecutive decline and was worse than consensus forecast. Here’s the latest from the CB’s press release:

Conference Board Leading Economic Index (LEI)