Measuring the real quality of internal leadership…

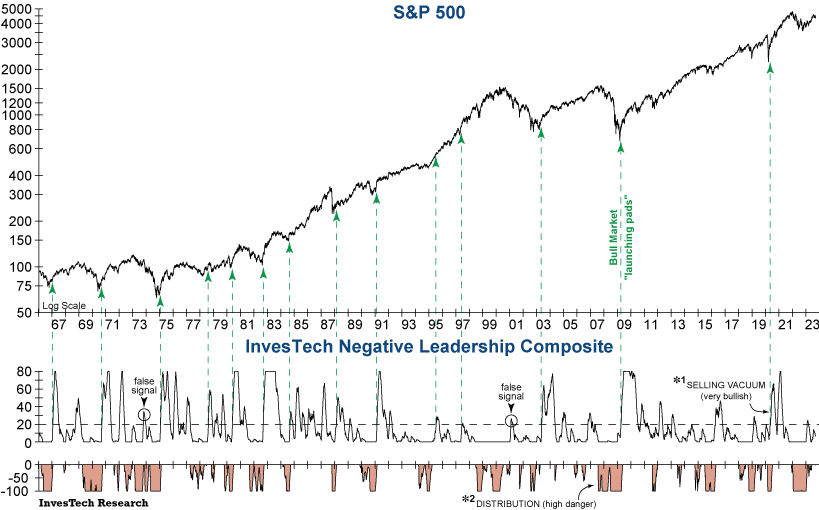

The Negative Leadership Composite (NLC) has served as one of InvesTech Research’s most reliable tools over our 40-year history for navigating bull and bear markets alike.

Selling Vacuum

The top half of our NLC, or what we call the bullish (*1) Selling Vacuum, rises as downside leadership evaporates. More often than not, the height and duration of this Selling Vacuum helps to indicate how strong a new bull market is – and how long it will last. For example, the instances when this indicator has climbed to very strong readings of +60 or +70, it confirmed the onset of a new multi-year bull market.

Distribution

The bottom (shaded) half of our NLC, also known as bearish (*2) Distribution, measures the rate of acceleration in downside leadership. This is the most vulnerable, dangerous region for the stock market… it is when bear markets can strike.

Obviously, this Negative Leadership Composite doesn’t provide signals very often. When Distribution (shaded region) is present, it’s time to be more cautious and carry a higher cash reserve. But when a Selling Vacuum appears (especially after 6+ months of Distribution), it’s time to take notice and get ready to jump on a charging new bull market in stocks.

Subscribe to see specific selling vacuum and distribution readings and gain access to all remaining InvesTech Indicators which are updated daily.

Get to know other Subscriber Resources & Tools.